6 Budget Binder Ideas And How to Make One!

Image by Kat Brancato

This post contains Amazon and other Affiliate Links, which means at no extra cost to you, I make a commission if you purchase through these links. For additional information, see my Disclosure & Disclaimer Page.

Budgeting paves the way to financial success. It helps you stay on track with your finances, prevents overspending, and can help you save money. Having a physical budget binder makes managing your money much easier. I rounded up the best budget binder ideas so you can tackle your finances effortlessly.

In this article, I’ll explain what a budget binder is, give details on the top budget binder ideas, and explain how to create your own!

What is a Budget Binder?

A budget binder is a financial planner where you can track your bills, income, and savings goals and even keep your financial documents. For example, you would have an expense tracker for your monthly bills, your income tracker, savings goals and worksheets, and other financial goals you may have.

Plus, you can dedicate a section to keep your account statements and bills. The best thing about having a money binder is you can create it any way you like!

Benefits of Using a Budget Binder

There are many benefits to using a budget binder. It helps you track your expenses and income so you know exactly how much money goes out and comes in every month. You can also use it for tracking your savings goals and your debt payoff strategy.

You can input a monthly calendar, so you know the dates your bills are due to prevent you from paying them late.

Another fantastic benefit is having all of your financial documents in one convenient location! You can purchase a large 3-ring binder, so you have enough space for everything you need.

Having a physical money binder really helps you have a clear vision of your overall financial picture.

6 Savvy Printable Budget Binder Ideas

There are so many fantastic budget binder ideas to choose from. Here are some of the best ones to try:

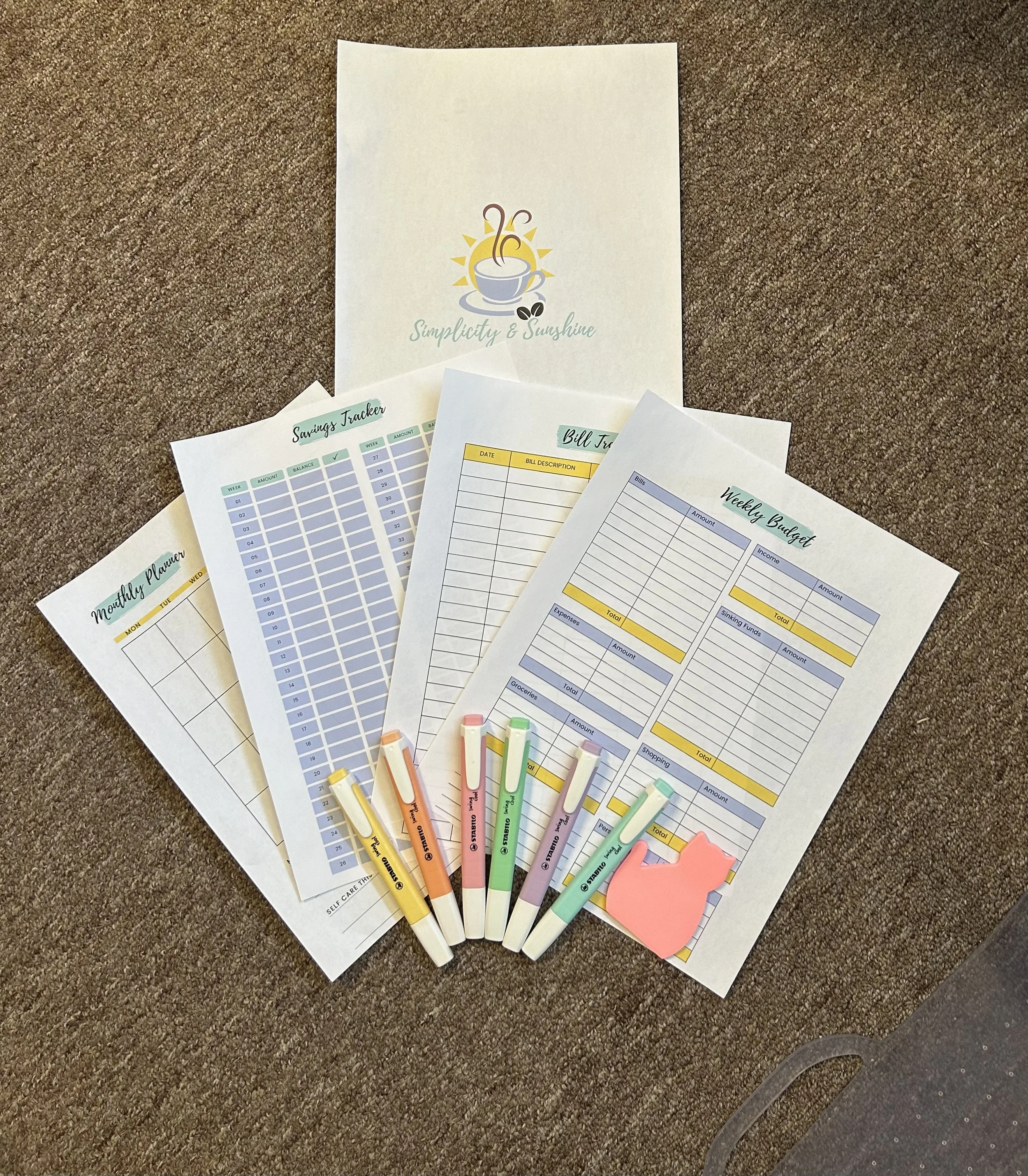

Simplicity & Sunshine Ultimate Planner Bundle

If you are looking for an all-in-one planner bundle, then this one is for you! This bundle is by yours truly aka Simplicity & Sunshine. It has a weekly budget sheet, a savings tracker, and a bill tracker. It also features daily, weekly, and monthly planner sheets, along with a goal tracker.

Here's what this planner includes:

Simplicity and Sunshine Cover Sheet

Daily Planner Sheet

Weekly Planner Sheet

Monthly Planner Sheet

Monthly Reflection Sheet

Yearly Overview Sheet

Weekly Budget Sheet

Savings Tracer Sheet

Bill Tracker Sheet

To-Do List Sheet

Habit Tracker Sheet

Cleaning List Sheet

Goal Tracker Sheet

Contact List Sheet

This Ultimate Bundle Planner is FREE—for now! Simply opt-in and get instant access to download your new planner.

30 Days Blog Budget Printables

If you would like to have a printable that you have the ability to edit, then you should grab the printable budget binder from the 30DaysBlog Etsy shop.

The planner normally costs $9.97, but you have the ability to customize it however you want. Once you purchase the file, you will have instant access so you can get started making your money binder right away.

Here is what is included in this bundle:

Budget Binder Spine + How to Put the Binder Together

Resources

Budget Binder Cover

Weekly Ledger

Monthly Ledger

Savings Information

Outstanding Debt Information

Month at a Glance Filled In

Month at a Glance Blank

Year at a Glance

Bill Payment Schedule

Bill Overview

Snowball Calculator

Tax Checklist Overview

Tax Checklist Blank

1-Year Savings Challenge Filled In

1-Year Savings Challenge Blank

No-Spend Month

Meals for This Month

Grocery List

If you like the style and aren't bothered about being able to edit the printables, she offers an older free version of this bundle on her blog. You just opt-in to her newsletter and will receive the bundle for free!

The Financial Cookbook Expense Tracker

Another one of my favorite budget binder ideas is by Lisa from the Financial Cookbook. The design is adorable, and she offers this bundle free on her site. Another cool sheet she includes is a Debt Snowball Tracker so you can easily start paying off your debts.

Here is what is included with this money binder bundle:

Monthly Budget Tracker

Yearly Budget Tracker

Spending Log

Housing Expenses Sheet

Car Expenses Sheet

Other Expenses Sheet

Food & Alcohol Expenses Sheet

Extra Expenses Sheet

Fun Expenses Sheet

Miscellaneous Expenses Sheet

Savings Tracker

Debt Payments Tracker

Debt Snowball Tracker

This planner is fantastic for keeping track of all of your expenses, including your fun ones. Grab this budget binder for free here!

Single Mums Income Printable Budgeting Sheets

If you want a simple yet effective budgeting system, then check out the free printables offered by Single Mums Income. She lists the links to each sheet so you can pick and choose which ones you want.

Here are the budgeting sheets and printables that are offered for free:

Budget Sheet

Expense Tracker

Goals Sheet

Monthly To-Do List

Menu Plan Sheet

Click here to get access to these fantastic printables. If you prefer to have something already set up, you can purchase her Budget Planner & Financial Organizer on Amazon for $7.99.

Activated Nest Debt Snowball Tracker

Although you can mix and match your budget binder ideas, you need to ensure you have a debt tracking sheet included in your planner.

The Debt Snowball Method is one of the best debt payoff strategies you can use. So if you opt for a binder that doesn't include one, then make sure you grab this free Debt Snowball Tracker by the Activated Nest!

Frugal Confessions Sinking Funds Trackers

Do you have a sinking fund saved up? A sinking fund is money you set aside for a planned expense. You can set up multiple sinking funds for various costs you may accrue. For instance, a vacation sinking fund or a sinking fund for expected house expenses.

Saving trackers are an essential part of your budget binder. Frugal Confessions offers nine styles of free sinking funds printables on their site.

Here are the available printables:

Yearly Sinking Funds Tracker

Simple Pink Fund Tracker

Envelope Sinking Fund Tracker

Sinking Fund Tracker for Multiple Goals

Classy Sinking Funds Tracker

12-Month Sinking Funds Tracker

Multiple Goal Tracker for Sinking Funds

Sinking Funds Savings Account Tracker

Fun Visual Sinking Funds Tracker

Not only does Amanda offer these fantastic trackers she has printable cash envelopes for free too! This is perfect if you're trying to make a budget binder with envelopes.

Grab your sinking printables here and check out her post "8 Free Printable Cash Envelopes" to get access to free envelope printables!

How to Make a Budget Binder

Are you ready to make your own money binder and take control of your finances? Setting up a binder is actually fun, and you get to make it custom to your needs. Here is how to make a budget binder you will love:

Get Supplies

The first thing you need is to get supplies to make your binder. Here are the supplies you will need to get started:

You can save money on supplies by shopping for your items at the Dollar General, Dollar Tree, or even Amazon.

2. Select Your Budget Binder Printables

The next step is to choose some printables from our budget binder ideas list. Remember to choose the printables that will make budgeting easier for you. That way, you are more likely to stick with it.

Also, have trackers and sheets for various budget binder categories so you can keep up with all aspects of your finances.

3. Categorize Your Budget Binder

Now comes the fun part! You get to set up your budget binder categories and sections and customize them to your liking. You can even make fun cover pages for each section and use markers, washi tape, and stickers to customize them.

Here is an example of an efficient money binder system:

Monthly Budget and Expenses Section

The first section of your budget binder categories will include your monthly budget, bill tracker, and expense printables. You can use your budget printable for whatever budget method you are using, so you stay accountable.

The bill tracker will help you pay your bills on time and help you remember if you paid or not. Be sure to track all of your expenses, no matter what they are. This will help you keep a tight grip on your hard-earned money!

Income Tracker

Your next section should be dedicated to all of your income. Use an income tracker for all the income you bring in. This includes your full-time job, side hustles, etc. If you are splitting bills with your partner, then it's also essential to include their income.

Financial Goals

It's important that you include a section for your financial goals. Making your goals visual helps keep you motivated and focused on achieving them. So, sit down and make short-term, mid-term, and long-term money goals you want to accomplish.

Some financial goals examples include saving for a vacation, a new car, or becoming a homeowner. Think about your goals and write them down along with the amounts you need to save to attain them.

Savings Trackers

It's much easier to save money when it's fun. Plus, tracking how much you save every week or month will boost your motivation to keep saving!

Try printing out various money-saving challenges and trackers for your sinking funds. Use your colorful pens and markers to log all of your deposit amounts each week.

Debt Tracker

Use this section for your debt payoff trackers. If you are using the Debt Snowball or Avalanche Method, then input those printables so you can successfully get out of debt faster.

Whatever method you use, ensure you keep up with your debt amounts, so you know where you stand financially.

Financial Documents and Bills

One of the best things about having a budget binder is keeping all of your financial statements and bills in one spot. So, in the back of your money binder, create sections for your bank statements and monthly bills. Use a hole punch so you can neatly file your documents in your binder.

You can set up your binder any way you like. Remember, if you use the cash envelope system, have a budget binder with envelopes and dedicate a specific section to that.

5. Update Your Binder Frequently

It's vital that you regularly review your budget and finances. This way, you can see what is working or isn't working with your budget. It makes you aware of how much money is being spent and if you are making enough money for your lifestyle.

So, set up a day each month to go over your money binder. You can make it fun by having dessert while you do it or rewarding yourself with a special treat once you're done. This way, it makes it seem like less of a chore.

Use These Budget Binder Ideas to Tackle Your Finances!

Now you know how to make a budget binder that is best for you! Utilize the awesome printables available and regularly review your finances to stay on track with your money goals.

A money binder will help keep you accountable for your finances, and you will have everything you need in one place.